Table of Contents

ToggleThe on-demand grocery delivery market has rapidly shifted from a luxury convenience to a critical service for millions. In the U.S. alone, online grocery sales are projected to reach $327.7 billion in 2025 and climb to $363.8 billion in 2026, reflecting sustained consumer embrace of digital shopping habits.

This explosive growth signals substantial opportunity for entrepreneurs and enterprises entering instant commerce. The global online grocery market is expected to grow from $542.7 billion in 2024 to $659.7 billion in 2025, representing a 21.6% year-over-year increase—a testament to booming demand.

This guide equips you with everything needed to build a Gopuff-style grocery app in 2025, from must-have features and technical architecture to cost estimates and competitive strategies.

How Big Is the Grocery Delivery App Market in 2025?

On-demand grocery delivery isn’t a temporary trend—it has reshaped consumer expectations and retail models. Today, 28.2% of American adults shop for groceries online monthly, while another 26.4% use a mix of online and in-store methods. Online grocery sales in the U.S. are projected to reach nearly $220 billion in 2024—about 12.5% of total grocery spending—and are expected to climb past $340 billion by 2027. Clearly, convenience and digital access are now fundamental to grocery shopping.

This wave has driven the growth of dark stores—delivery-focused micro-warehouses that power Q-commerce and enable 15- to 30-minute deliveries. They’re leaner and strategically placed to serve high-demand areas quickly. These facilities rely on AI to forecast demand and reduce stock-outs, driving operational efficiency without the overhead of traditional stores.

Gopuff exemplifies this successful model. With over 20 million downloads and 1.8 million active users, the company controls its inventory and fulfillment, ensuring consistent quality and a reliable 30-minute delivery promise. Its technological backbone and strategic dark-store network have built both consumer trust and market presence.

Within this dynamic space, Gopuff has emerged as a dominant force. The platform generated approximately $1.2 billion in revenue in 2023, commanding around 75 % of the U.S. first-party convenience delivery market. Its scale and efficiency highlight the viability of a vertically integrated instant commerce model.

The Q-commerce market is rapidly expanding. In the U.S., it’s projected to hit $62.6 billion in 2025, with 74 million users expected by 2030. As players scale across regions and product lines, it’s evident that instant grocery delivery has become a standard in modern retail.

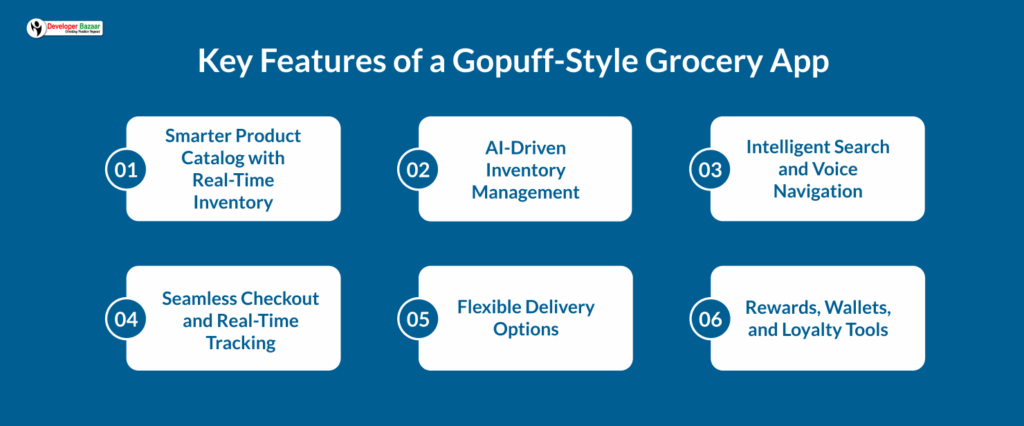

Key Features of a Gopuff-Style Grocery App

Developing To succeed in today’s instant commerce space, your grocery app must deliver on speed, simplicity, and personalization. Here are the essential features that define a Gopuff-like experience:

Smarter Product Catalog with Real-Time Inventory

Your catalog should reflect live inventory, offer accurate descriptions and high-quality images, and support dynamic pricing based on demand and promotions. Smart recommendations and intuitive category filters ensure a seamless browsing experience.

AI-Driven Inventory Management

AI tools can predict demand, automate reordering, and track expiration dates—reducing waste and improving stock accuracy across dark stores. A centralized backend streamlines multi-location management.

Intelligent Search and Voice Navigation

Search should anticipate intent with predictive suggestions, voice input, and even visual search. Add barcode scanning and filters for dietary needs, price, and availability for faster reordering.

Seamless Checkout and Real-Time Tracking

Enable fast, flexible checkout with saved payment methods, promo codes, and delivery preferences. Real-time GPS tracking, push alerts, and in-app messaging keep customers informed every step of the way.

Flexible Delivery Options

Support 30-minute express delivery, scheduled slots, group orders, and subscriptions with perks like free delivery or early slot access to boost loyalty and retention.

Rewards, Wallets, and Loyalty Tools

Drive repeat usage with tiered loyalty programs, personalized offers, and cashback rewards. Integrated wallets allow easy top-ups and shared family usage—making grocery management frictionless.

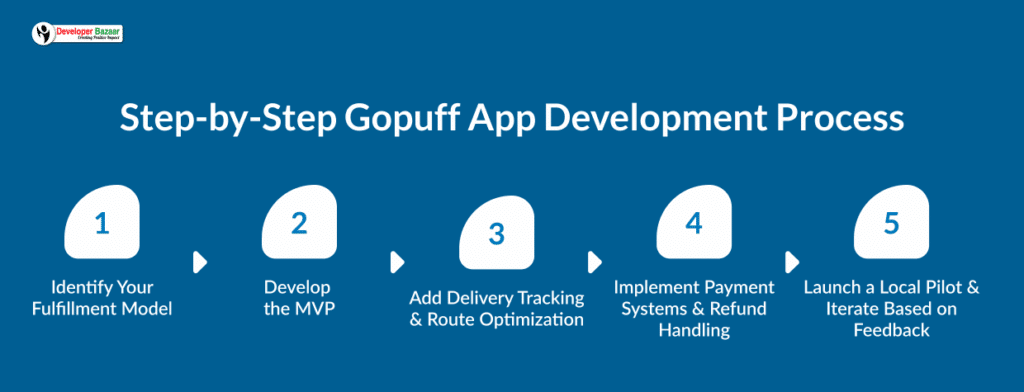

Step-by-Step Gopuff App Development Process

Successful on-demand delivery app development requires systematic planning and execution across multiple phases. This structured approach ensures efficient resource utilization while delivering high-quality solutions that meet market demands.

Step 1: Identify Your Fulfillment Model

Selecting between an inventory-first, third-party marketplace, or hybrid model defines your app’s trajectory. Follow Gopuff’s approach—owning inventory and fulfillment—if you aim for full control over product quality, delivery speed, and user experience, but be prepared for substantial capital investment and complex systems like demand forecasting.

Alternatively, a marketplace model offers faster and cheaper entry by partnering with local retailers, relying on commission-based revenue. A hybrid model balances both—stocking essentials in-house while linking with third-party vendors—but requires sophisticated logistics coordination and overhead management.

Step 2: Develop the MVP (Customer + Admin App)

Launching an MVP focused on core features validates your concept while conserving resources. On the customer side, this includes registration, a searchable catalog, cart and checkout flows, order tracking, and support integration.

The admin panel should support inventory control, order processing, driver dispatching, analytics, and service tools. Industry benchmarks suggest the MVP development phase usually spans 3–4 months and costs around $100,000+.

Step 3: Add Delivery Tracking & Route Optimization

Efficient logistics set high-performing grocery apps apart. Integrate real-time traffic data to dynamically route drivers, optimize multi-stop journeys, monitor driver performance, and manage vehicle capacity. A robust tracking system with GPS updates, ETAs, exception alerts, and in-app communication ensures transparency and reliability.

Step 4: Implement Payment Systems & Refund Handling

Secure and flexible payment support builds trust and enables scale. Incorporate multiple gateways, ensure PCI DSS compliance, support multi-currency transactions for expansion, and include subscription billing. Streamlined refund processes—such as automated reimbursements or store credits—plus clear dispute-resolution flows and comprehensive financial reporting are essential for operational clarity and user satisfaction.

Step 5: Launch a Local Pilot & Iterate Based on Feedback

Launching in 2–3 targeted neighborhoods lets you fine-tune systems before scaling. Begin with a curated range of core products (covering roughly 80% of demand), then systematically monitor delivery times, order accuracy, and satisfaction scores. Use user surveys and app-store reviews to pinpoint issues.

Then prioritize improvements in inventory forecasting, route planning, UX refinement, and app performance. Most importantly, validate your unit economics, ensuring that both customer acquisition and delivery costs align with sustainable margins.

Tech Stack and Tools for Gopuff-Like Grocery Apps

Selecting the right tech stack ensures your grocery app is fast, scalable, and ready for growth.

Backend Development:

Node.js with Express is a top choice for real-time order tracking and concurrent requests. Its non-blocking architecture enables smooth performance, while Express helps structure APIs efficiently for microservices. For rapid MVP development, Firebase offers real-time databases, authentication, and hosting out-of-the-box.

It’s great for early-stage builds but may lead to vendor lock-in and higher costs at scale. If your app involves complex data processing, Python with Django or Java with Spring Boot provide robust alternatives. Django’s ORM and analytics capabilities suit content-heavy systems, while Spring Boot is ideal for high-security, high-volume enterprise apps.

Frontend Development:

Flutter enables cross-platform deployment from a single codebase with near-native performance. Google backs it and reduces development time by up to 30%.

For deeper device integration or platform-specific features, native development with Swift (iOS) or Kotlin (Android) remains a strong option, though it increases development and maintenance effort.

Mapping & Logistics APIs:

Use Mapbox for custom maps and affordable pricing or Google Maps Platform for extensive global coverage.

Add route optimization with services like RoadWarrior or Route4Me, or consider building proprietary algorithms tailored to your delivery operations.

Inventory & ERP Integration:

Connect with full-suite solutions like SAP Business One, NetSuite, or Odoo to manage supply chain and order workflows.

For leaner inventory needs, tools like QuickBooks Commerce or Cin7 offer solid integration with ecommerce platforms.

Push Notification Services:

Firebase Cloud Messaging is a free, cross-platform tool with analytics and segmentation. Alternatives like Amazon SNS, OneSignal, and Pusher offer advanced controls for complex notification flows.

Development Cost: Gopuff-Like App in 2025

Understanding development costs helps establish realistic budgets and make informed decisions about feature prioritization and technical approaches.

Cost Estimation by Feature Tier

| Complexity Level | Development Time | Investment Range | Core Features Included |

|---|---|---|---|

| MVP Version | 3-4 months | $25,000 - $45,000 | Basic product catalog, simple checkout, order tracking, admin panel |

| Standard App | 4-7 months | $45,000 - $95,000 | Advanced search, loyalty programs, multiple payment methods, route optimization |

| Complex Apps | 7-12 months | $95,000 - $180,000 | Real-time tracking, AI recommendations, advanced analytics, multi-location management |

| Enterprise Solution | 12+ months | $180,000+ | Custom ERP integration, advanced logistics, white-label capabilities, enterprise security |

Developer Rates by Region

Development costs vary significantly across geographies, influenced by factors like labor rates, technical expertise, and project complexity. Choosing the right region can impact not only your budget but also the speed and quality of delivery.

Eastern Europe, including countries like Poland, Ukraine, and Romania, has emerged as a popular destination for quality development work. With strong STEM education systems, timezone alignment with Western Europe, and fluent English-speaking talent, it’s ideal for mid-sized to enterprise-level builds.

- Hourly rates: $30–$60

- Total project cost: $30,000–$90,000

Asia, led by India, Vietnam, and the Philippines, remains the most cost-effective region for outsourcing. It offers an established outsourcing ecosystem, a vast talent pool, and highly competitive pricing, especially for mobile application development and scalable long-term builds.

- Hourly rates: $25–$40

- Total project cost: $20,000–$65,000

In North America, particularly the U.S. and Canada, you’ll pay a premium for top-tier expertise, product strategy guidance, and native English fluency. This region is well-suited for complex, compliance-heavy, or heavily customized applications.

- Hourly rates: $100–$200

- Total project cost: $75,000–$240,000

Western Europe, including the UK, Germany, and the Netherlands, provides a solid middle ground—offering cultural proximity to the U.S. and GDPR-aware workflows. It’s a strong option for high-quality builds requiring both performance and regulatory compliance.

- Hourly rates: €80–€140 ($85–$150)

- Total project cost: $60,000–$170,000

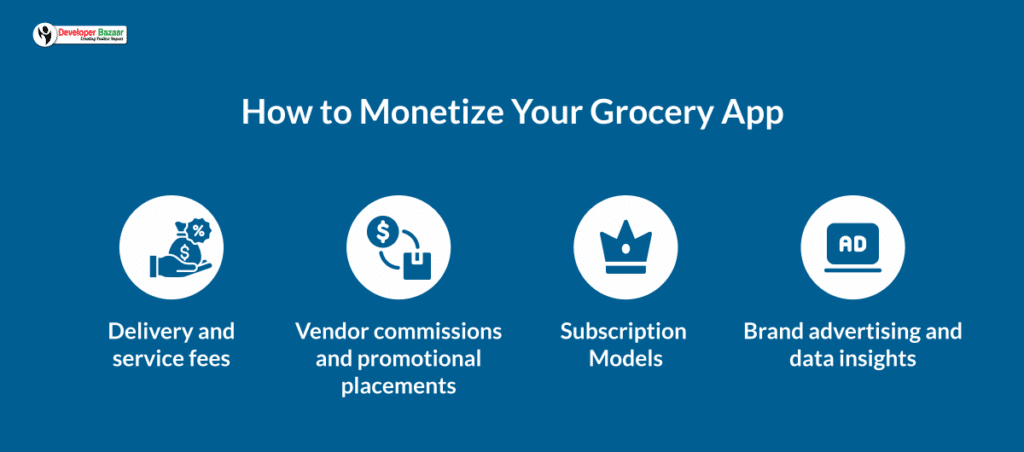

How to Monetize Your Grocery App

A robust monetization model is essential for long-term sustainability and competitiveness in the grocery delivery landscape. Your strategy should balance customer value with operational efficiency, enabling growth without compromising service quality.

A robust monetization model is essential for long-term sustainability and competitiveness in the grocery delivery landscape. Your strategy should balance customer value with operational efficiency, enabling growth without compromising service quality.

One of the primary revenue channels is delivery and service fees. Most platforms charge based on distance, order value, and delivery urgency. These fees also help optimize order volume and reduce cart abandonment. Many apps implement dynamic pricing based on location, demand, and time of day. Additionally, small order surcharges and platform usage fees contribute to operational cost recovery.

- Delivery fees typically range between $2.99 and $5.99, based on distance

- Express deliveries (15–30 minutes) often carry a 25–50% markup

- Free delivery thresholds usually fall between $20 and $35 per order

Another significant revenue source comes from vendor commissions and promotional placements. Marketplace sellers pay a percentage of every sale for platform access. Higher-tiered promotional options—such as featured listings, category sponsorships, or prioritized search placement—are attractive to brands looking for exposure. These monetization opportunities are often bundled with analytics tools, inventory support, and marketing services.

- Standard commission rates hover between 15% and 25%

- Premium placements can generate between $500 and $5,000 per month

To improve retention and recurring revenue, subscription models are increasingly popular. These plans provide free delivery, priority support, and exclusive deals, offering tangible value for frequent shoppers. They also significantly increase lifetime customer value, reduce churn, and encourage larger basket sizes.

- Subscription pricing ranges from $9.99/month (Basic) to $29.99/month (Family)

- Subscribers typically show 2–3x higher lifetime value and 40–60% more frequent orders

Additional monetization options include brand advertising and data insights. Sponsored placements, in-app ads, and branded campaigns are ideal for CPG brands targeting high-intent buyers. Meanwhile, anonymized consumer data can be offered to suppliers and partners as packaged insights or industry benchmarks.

- Sponsored brand campaigns can generate $5,000–$25,000/month

- Data licensing for insights or trends may yield $10,000–$50,000+, depending on scope

Conclusion

With online grocery sales in the U.S. projected to reach $363.8 billion in 2026, the market is both lucrative and fiercely competitive. Success now demands smart differentiation and solid operational execution.

AI-powered Personalization isn’t optional—it’s essential. AI tools for demand forecasting, personalized recommendations, and dynamic pricing significantly optimize inventory and boost conversions. AI-driven loyalty programs have also increased customer engagement by 10–20% and retention by 15–25%.

Going hyperlocal strengthens community ties, accelerates delivery, and builds brand loyalty through neighborhood-tailored product assortments. Niche strategies—like organic, ethnic, or dietary-specific offerings—tap into higher-margin customer segments with reduced competition.

Tech differentiation—through voice ordering, AR previews, or smart-home integration—adds convenience and elevates the user experience, helping your app stand apart from generic platforms.

Ultimately, retention beats acquisition. Gamified loyalty schemes, referral programs, and re-engagement driven by customer tiering can triple lifetime value, ensuring long-term profitability. Operational excellence—balanced with rigorous unit economics, diversified revenue streams, and strategic partnerships—lays the foundation for sustainable growth.

Building a Gopuff-style grocery delivery app is a sizable investment, but with a focused strategy, customer-centric features, and disciplined execution, it can be an enriching venture.

FAQs

1. How much does building a grocery delivery app like Gopuff in 2025 cost?

Costs typically range from $25,000–$45,000 for an MVP to $180,000+ for enterprise apps. A full-featured app with real-time inventory, tracking, and payment integration generally falls between $45,000–$95,000. Costs vary based on features, team location, and tech stack.

2. What’s the average timeline for development?

Expect 3–4 months for MVPs, 4–7 months for standard builds, and up to 12 months for complex enterprise apps. Timelines depend on scope, tech stack, and whether you follow a phased rollout.

3. What tech stack should I choose?

Use Flutter for cross-platform apps and Node.js or Firebase for backend scalability. Essential integrations include Google Maps/Mapbox, Stripe, Firebase Cloud Messaging, and inventory tools like Odoo or QuickBooks Commerce.

4. How do grocery apps make money?

Revenue comes from:

- Delivery fees: $2.99–$5.99/order

- Service fees: 10–15% of order value

- Vendor commissions: 15–25%

- Memberships: $9.99–$29.99/month

Other sources include ads, brand placements, and data monetization.

5. What are the must-have features?

Core features include real-time inventory, AI-powered search, one-click checkout, live tracking, multiple payment options, and loyalty programs. Premium apps add subscription models and AI recommendations.

6. How can I compete with Gopuff or Instacart?

Stand out by focusing on niche categories (organic, ethnic), hyperlocal delivery, AI tools, and exceptional service. Strategic supplier partnerships and community engagement build long-term loyalty.

7. What are the ongoing costs post-launch?

Ongoing costs may include:

- Cloud hosting: $3,000–$12,000/year

- Maintenance: 15–20% of dev cost

- Marketing: 10–25% of revenue

- APIs & services: $2,000–$8,000

- Payment processing: 2.9% + $0.30/transaction

8. Should I use in-house inventory or a marketplace model?

In-house models (like Gopuff) offer more control and faster delivery but require capital investment. Marketplaces are easier to start, but risk third-party delays. A hybrid approach often works best—own fast-moving inventory, source the rest via vendors.

RM Mishra

Co-Founder

Developer Bazaar technologies