Table of Contents

ToggleWhat Is MoneyLion & Why It’s a Fintech Leader

MoneyLion has established itself as a comprehensive financial wellness platform that goes beyond simple cash advances. The app combines instant cash access with credit monitoring, investment tools, and personalized financial coaching, creating an all-in-one solution for users seeking financial stability.

What sets MoneyLion apart is its data-driven approach to lending. The platform uses AI-powered risk assessment to evaluate users based on banking behavior, spending patterns, and income stability rather than traditional credit scores alone. This approach enables faster approvals and more accurate lending decisions, making financial services accessible to users who might be overlooked by traditional banks.

The shift to mobile-first cash advance solutions represents a fundamental change in how financial services are delivered. Modern users expect seamless, app-based experiences that integrate with their daily financial routines. MoneyLion’s success demonstrates that comprehensive financial wellness platforms outperform single-purpose lending apps, creating stronger user engagement and higher lifetime value.

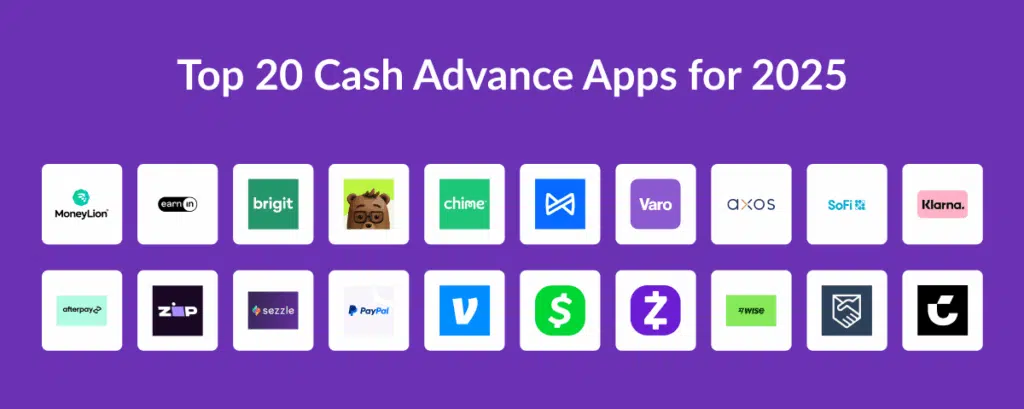

Top 20 Cash Advance Apps for 2025

The instant cash apps market offers diverse solutions tailored to different user needs and financial situations. These top cash advance apps are reshaping how Americans access emergency funds and manage short-term financial challenges:

MoneyLion – Instant Advances & Financial Tools

MoneyLion remains among the leading advance cash apps with its comprehensive financial wellness approach, offering up to $500 instant advances alongside credit monitoring and investment tools. The platform’s AI-driven risk scoring and no-interest advance options make it particularly attractive to users seeking transparent, affordable financial solutions.

Earnin – Pay-As-You-Go Wage Access

Earnin pioneered the “pay-as-you-go” model among instant cash apps, allowing users to access earned wages before payday without traditional fees. The app’s unique voluntary tipping system and integration with time-tracking tools appeal to hourly workers and gig economy participants seeking flexible cash flow management.

Brigit – Overdraft Safety & Smart Budgeting

Brigit focuses on overdraft protection and budgeting tools, providing advances up to $250 with automatic budgeting insights. This platform demonstrates how top cash advance apps can combine emergency funding with financial education to help users avoid recurring cash flow issues.

Dave – Advances, Side Hustles & Savings

Dave offers a combination of cash advances, budgeting tools, and side hustle opportunities. The app’s social features and gamified savings challenges create an engaging user experience that encourages long-term financial wellness beyond immediate cash needs.

Chime – Digital Banking with Early Pay

Chime functions as a full-service digital bank with early paycheck access and no-fee overdraft protection. The platform’s comprehensive banking services and automatic savings features make it ideal for users seeking a complete banking alternative with instant cash benefits.

Albert – Cash Advances & AI Coaching

Albert combines cash advances with investment services and financial advisory support. The app’s AI-powered financial coaching and automated savings features appeal to users seeking comprehensive financial growth alongside emergency cash access.

Additional notable platforms include Varo, Current, Axos Bank, SoFi, Klarna, Afterpay, Zip, Sezzle, PayPal, Venmo, Cash App, Zelle, Wise, and Remitly, each offering unique features and targeting specific user segments within the broader advance cash apps ecosystem.

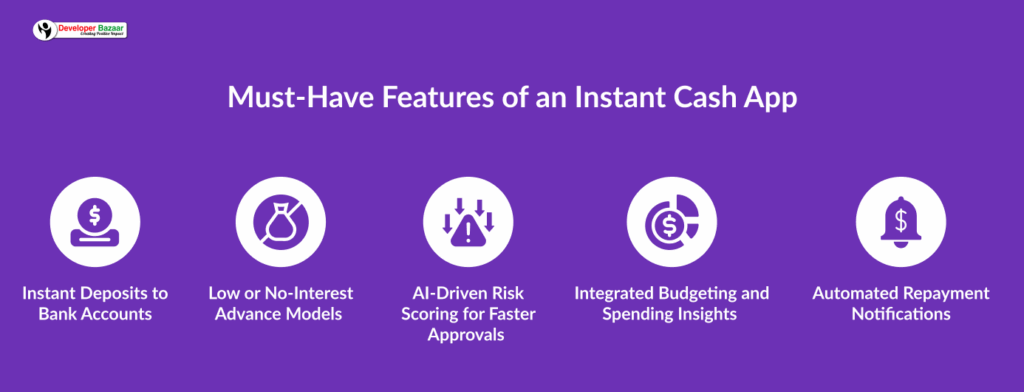

Must-Have Features of an Instant Cash App

Building successful advance cash apps requires balancing user convenience with financial security and regulatory compliance. The most effective instant cash apps incorporate features that address immediate cash needs while promoting long-term financial wellness.

Instant Deposits to Bank Accounts

Instant deposit to bank accounts serves as the foundation of any top cash advance apps. Users expect funds to appear within minutes of approval, requiring robust integration with banking networks and real-time payment processing systems. This feature directly impacts user satisfaction and retention rates.

Low or No-Interest Advance Models

Low or no-interest advances differentiate modern instant cash apps from traditional payday lenders. The most successful platforms use subscription models, voluntary tipping systems, or cross-subsidization through other services to minimize direct lending costs while maintaining profitability.

AI-Driven Risk Scoring for Faster Approvals

AI-powered risk scoring enables more accurate lending decisions and faster approvals in advance cash apps. By analyzing banking behavior, spending patterns, and income stability, these systems can evaluate creditworthiness without traditional credit checks, making services accessible to underbanked populations.

Integrated Budgeting and Spending Insights

Spending insights and budgeting tools transform instant cash apps from emergency solutions into comprehensive financial wellness platforms. These features help users understand spending patterns, identify areas for improvement, and build better money management habits that reduce reliance on cash advances.

Automated Repayment Notifications

Push notifications for repayment reminders ensure timely repayment while maintaining positive user relationships. Smart notification systems use behavioral data to optimize timing and messaging, improving collection rates without creating user friction.

How It Works: Instant Cash User Journey

The user experience in top cash advance apps must balance speed with security, ensuring quick access to funds while maintaining proper verification and compliance protocols that meet fintech industry standards.

Application setup begins with account creation and basic identity verification. The most effective instant cash apps streamline this process using automated document scanning, phone number verification, and integration with existing banking relationships to minimize friction while ensuring security.

Income verification typically involves connecting bank accounts or payroll systems to verify employment and income stability. Advanced advance cash apps use AI for loan lending to analyze banking patterns and predict income timing, enabling more accurate advance amounts and repayment scheduling.

Cash advance request should be completed within minutes through intuitive mobile interfaces. Users select advance amounts, review terms, and confirm repayment schedules through streamlined flows that minimize decision fatigue and abandonment rates.

Funds disbursement occurs through real-time payment networks or instant transfer systems. The most competitive instant cash apps offer same-day or instant transfers, often at no additional cost, using partnerships with banking networks and payment processors.

Repayment process typically involves automatic bank debits on scheduled dates, usually aligned with user payday schedules. Smart advance cash apps offer flexible repayment options, payment date adjustments, and clear communication about upcoming debits to maintain positive user relationships.

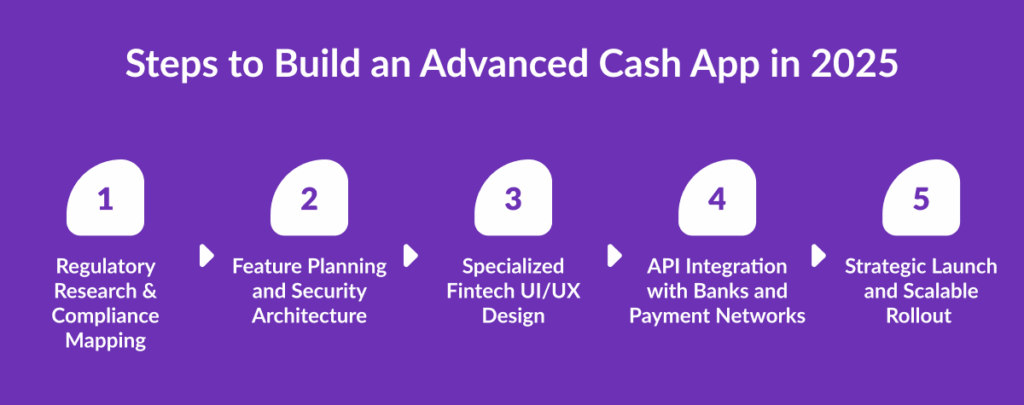

Steps to Build an Advanced Cash App in 2025

Developing successful instant cash apps requires careful planning around regulatory compliance, user experience design, and scalable technology infrastructure. Professional mobile app development services ensure proper implementation of these complex requirements.

Regulatory Research and Compliance Mapping

Market research and compliance mapping form the foundation of any fintech development project. Each state maintains different regulations around cash advances, interest rates, and lending practices. Understanding these requirements early prevents costly redesigns and ensures proper licensing before launch.

Feature Planning and Security Architecture

Feature design and security planning must balance user convenience with robust financial security. This includes implementing multi-factor authentication, encryption for sensitive data, fraud detection systems, and secure API connections with banking partners – all critical elements that experienced fintech application development companies handle systematically.

Specialized Fintech UI/UX Design

UI/UX development for fintech apps requires specialized expertise in financial user interfaces. The design must instill trust while maintaining simplicity, using clear visual hierarchies, intuitive navigation, and accessibility features that serve diverse user populations seeking top cash advance apps.

API Integration with Banks and Payment Networks

Integration with banking APIs and payment processors enables core functionality like account verification, balance checking, and fund transfers. Professional mobile app development services ensure reliable, secure connections to user financial accounts through partnerships with services like Plaid, Yodlee, and major payment networks.

Strategic Launch and Scalable Rollout

Launch and scale involves careful rollout planning, starting with limited geographic markets to test compliance and user adoption before expanding. Successful launches typically include partnerships with employers, financial institutions, or community organizations to build initial user bases for advance cash apps.

Tech Stack for Cash Advance App Development

Selecting the right technology foundation is crucial for building secure, scalable cash advance platforms that can handle sensitive financial data and high transaction volumes.

Core frameworks like Flutter and React Native provide cross-platform development efficiency while maintaining native performance. These frameworks are particularly valuable for fintech apps that require consistent user experiences across iOS and Android platforms with frequent updates and feature additions.

Backend infrastructure using Node.js or Python Django provides the computational power needed for real-time financial processing, AI-driven risk assessment, and secure data management. These platforms offer robust libraries for financial calculations, database management, and API integration.

AI and machine learning capabilities through TensorFlow or PyTorch enable advanced risk scoring, fraud detection, and personalized financial insights. These tools analyze user behavior patterns, spending habits, and income stability to make accurate lending decisions without traditional credit checks.

Banking APIs from providers like Plaid, Yodlee, and MX connect apps to user bank accounts for income verification, balance checking, and automatic repayment processing. These services handle the complexity of banking integration while ensuring security and compliance.

Cloud infrastructure through AWS, Azure, or Google Cloud provides scalable hosting, data storage, and processing power needed for financial applications. These platforms offer specialized fintech services, security certifications, and compliance tools that reduce development complexity.

Cost to Develop a Cash Advance App Like MoneyLion

Understanding development costs is essential for budgeting and investor planning. Cash advance apps require specialized fintech expertise and robust security measures that impact initial investment and ongoing operational expenses.

| Complexity | Timeline | Cost Estimate |

|---|---|---|

| Basic MVP | 4–6 months | $60,000–$90,000 |

| Standard | 6–9 months | $90,000–$140,000 |

| Advanced | 9–12 months | $140,000–$220,000 |

Basic MVP costs cover essential features like user registration, income verification, simple cash advances, and basic repayment processing. This level includes core security measures and compliance features but limited AI capabilities or advanced financial tools.

Standard platforms add AI-powered risk scoring, budgeting tools, spending insights, and enhanced security features. These builds typically include partnerships with multiple banking APIs, advanced fraud detection, and more sophisticated user interfaces.

Advanced solutions incorporate comprehensive financial wellness features, investment tools, credit monitoring, and white-label capabilities. These platforms often include machine learning algorithms for personalized financial coaching, advanced analytics dashboards, and enterprise-grade security measures.

Additional costs include ongoing compliance maintenance ($15,000-$30,000 annually), third-party API fees ($500-$2,000 monthly per service), cloud infrastructure ($1,000-$5,000 monthly), and specialized fintech development talent that commands premium rates due to regulatory complexity and security requirements.

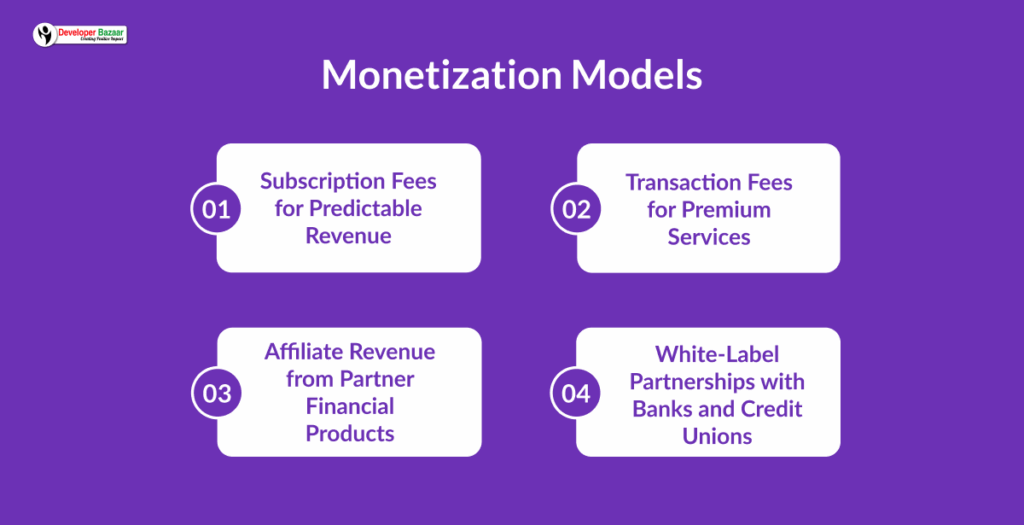

Monetization Options

Successful cash advance apps employ diverse revenue strategies that balance user affordability with business sustainability, often combining multiple approaches to maximize profitability while maintaining competitive pricing.

Subscription Fees for Predictable Revenue

Subscription fees provide predictable recurring revenue while offering users unlimited access to cash advances and premium features. Monthly fees typically range from $5-15, with some platforms offering tiered pricing based on advance limits and additional services like credit monitoring or investment tools.

Transaction Fees for Premium Services

Transaction fees generate revenue from specific actions like instant transfers, expedited processing, or premium banking services. These fees must be carefully balanced to remain competitive with traditional banking while providing value-added services that justify the cost.

Affiliate Revenue from Partner Financial Products

Affiliate financial products create additional revenue streams through partnerships with credit card companies, insurance providers, and investment platforms. These relationships allow apps to earn commissions while providing users with relevant financial products that complement cash advance services.

White-Label Partnerships with Banks and Credit Unions

White-labeling to credit unions and community banks represents a growing opportunity for established platforms to expand their reach while providing smaller financial institutions with modern fintech capabilities. These partnerships often involve revenue-sharing arrangements and can significantly increase user acquisition.

Conclusion

The instant cash apps market represents a permanent shift in how Americans access short-term financial services. As traditional banking continues to lag behind user expectations, top cash advance apps like MoneyLion demonstrate the power of comprehensive financial wellness solutions that go beyond simple lending.

Success in this market requires balancing user needs with regulatory compliance, technological innovation with financial security, and rapid growth with sustainable business models. The most effective advance cash apps combine instant cash access with financial education, budgeting tools, and personalized insights that help users build long-term financial stability.

For entrepreneurs and businesses considering entry into this market, partnering with experienced fintech application development companies ensures proper compliance, security, and user experience design. Professional mobile app development services provide the specialized expertise needed to navigate complex regulatory requirements while building scalable, user-friendly platforms that compete with established instant cash apps.

FAQs

Q. What are the top cash advance apps available in 2025?

The leading instant cash apps include MoneyLion, Earnin, Brigit, Dave, Chime, and Albert, each offering unique features like AI-powered risk scoring, budgeting tools, and instant fund transfers.

Q. How do advance cash apps ensure instant money transfers?

Top cash advance apps use real-time payment networks, banking API integrations, and partnerships with major financial institutions to enable same-day or instant transfers, often at no additional cost to users.

Q. What mobile app development services are needed for cash advance apps?

Professional mobile app development services must include fintech expertise, regulatory compliance planning, secure banking integrations, AI-powered risk assessment, and robust security measures for financial data protection.

Q. How do fintech application development companies ensure regulatory compliance?

Experienced fintech application development companies maintain expertise in state-by-state lending regulations, federal consumer protection laws, and banking partnership requirements to ensure full compliance before launch.

Q. What's the development timeline for building instant cash apps?

Professional mobile app development services typically require 6-12 months for advance cash apps, with basic MVP versions taking 4-6 months and advanced platforms with comprehensive features needing 9-12 months for full development.

RM Mishra

Co-Founder

Developer Bazaar technologies