Table of Contents

ToggleThe UAE food delivery market has transformed from a convenience service into an essential lifestyle component for millions of residents. Dubai, as the region’s commercial hub, leads this digital revolution with sophisticated platforms that cater to diverse culinary preferences and cultural expectations.

The numbers speak volumes about this explosive growth. The UAE food delivery market was valued at approximately $720.7 million in 2024 and is projected to reach $1,799.1 million by 2033, representing a compound annual growth rate of 10.2%. With Dubai residents using a food delivery app in the past year, the market demonstrates both maturity and continued expansion potential.

Why the Food Delivery Market in UAE is Thriving?

The UAE’s food delivery market has transformed into one of the fastest-growing sectors in the region. A blend of shifting consumer habits, a multicultural food landscape, supportive government policies, and cutting-edge technology has created fertile ground for rapid growth. From pandemic-fueled adoption to AI-driven delivery experiences, food delivery apps in Dubai and across the Emirates are redefining how people eat—and how businesses innovate.

Post-Pandemic Consumer Behaviors

The COVID-19 pandemic fundamentally shifted dining habits across the Emirates. What began as necessity during lockdowns evolved into preferred lifestyle choices. Dubai residents now view food delivery as a time-saving solution that fits seamlessly into their busy schedules, with 68% of users ordering food online at least twice weekly.

The multicultural nature of Dubai’s population has created unique demands for diverse cuisine options. From traditional Emirati dishes to international favorites, food delivery apps in Dubai must cater to over 200 nationalities, each with distinct culinary preferences and dietary requirements.

Rise of Food Delivery Startups in the UAE

The UAE government’s supportive stance toward digital innovation has fostered an environment where food delivery startups can flourish. Dubai’s strategic location as a business hub between East and West has attracted significant venture capital investment, with food tech companies raising over $280 million in funding during 2023-2024.

Local entrepreneurs are capitalizing on gaps left by international players, creating specialized platforms that understand regional preferences, cultural sensitivities, and unique market dynamics. These food delivery startups in the UAE are driving innovation through features like Ramadan-specific meal timings, halal certification verification, and Arabic-language customer support.

Technology Enablers

Advanced technology infrastructure has become the backbone of successful food delivery operations. AI-powered demand forecasting helps restaurants optimize inventory and reduce waste, while machine learning algorithms improve delivery route optimization, reducing average delivery times by 25% compared to traditional methods.

Real-time tracking capabilities, integrated payment systems supporting both international cards and local digital wallets, and seamless cashless payment options have elevated user expectations. The integration of smart city initiatives in Dubai has further enhanced delivery efficiency through traffic data integration and smart routing systems.

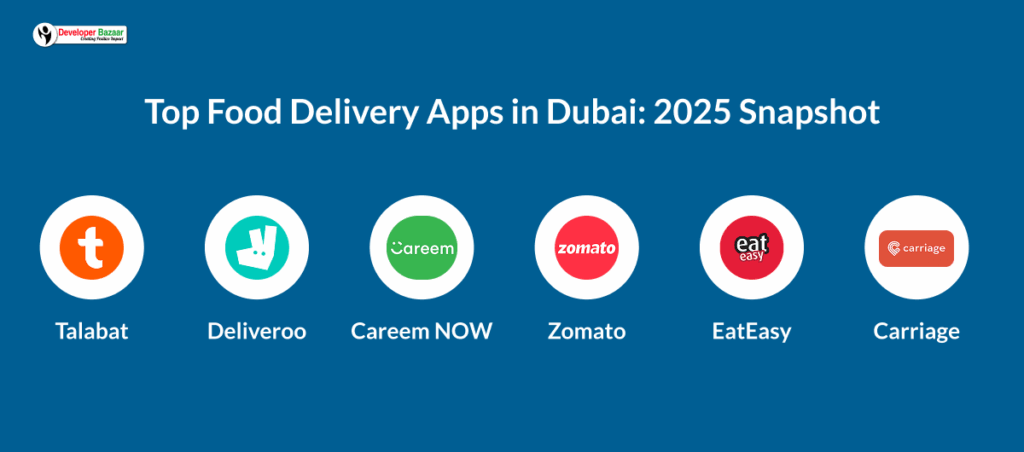

Top Food Delivery Apps in Dubai: 2025 Snapshot

Dubai’s food delivery scene is both vibrant and competitive, with established giants and agile local players vying for customer loyalty. From premium dining to community-focused services, each platform brings unique strengths. Here’s a brief look at the leading apps shaping how Dubai eats in 2025.

Talabat

As the market leader, Talabat commands approximately 45% market share in the UAE. The platform’s strength lies in its extensive restaurant network of over 15,000 partners and multilingual support that includes Arabic, English, and Hindi. Talabat’s loyalty program and subscription model offer free delivery for premium members, creating strong customer retention.

Deliveroo

Deliveroo holds around 25% market share, distinguished by its premium positioning and focus on quality restaurants. The platform’s signature feature is its network of cloud kitchens and exclusive partnerships with high-end dining establishments. Deliveroo Plus membership provides unlimited free delivery, appealing to frequent users.

Careem NOW

Zomato

EatEasy

Carriage

Holding 1% market share, Carriage positions itself as a premium delivery service with a white-glove delivery experience. The platform specializes in fine dining delivery, maintaining food quality through specialized packaging and trained delivery personnel.

Key Features of a Successful Food Delivery App in UAE

To stand out in the UAE’s competitive food delivery market, apps must deliver a seamless experience for users, restaurant partners, and administrators alike. From multi-language support to real-time tracking and robust analytics, here are the essential features driving success in Dubai and beyond.

User Panel

Multi-language support remains non-negotiable, with Arabic and English as minimum requirements, though successful apps often include Hindi, Urdu, and other regional languages. This linguistic accessibility ensures comfort for Dubai’s diverse population and demonstrates cultural sensitivity.

Seamless payment integration supports international credit cards, local debit cards, digital wallets like Apple Pay and Google Pay, and cash on delivery options. The variety accommodates different user preferences and financial habits, from tech-savvy millennials to traditional cash users.

Real-time order tracking with GPS integration provides transparency and reduces customer anxiety. Advanced tracking includes estimated delivery times, driver location updates, and proactive communication about delays or changes.

Restaurant/Delivery Partner Panel

Menu management systems allow restaurants to update prices, availability, and special offers in real-time. Smart inventory integration helps prevent orders for out-of-stock items, improving customer satisfaction and reducing operational friction.

Order acceptance and routing features optimize kitchen workflows and delivery logistics. Automated order assignment based on location, capacity, and delivery time preferences ensures efficient operations and timely deliveries.

Comprehensive earnings dashboards provide restaurants and delivery partners with detailed analytics on performance, popular items, peak hours, and revenue trends. This data empowers partners to make informed business decisions and optimize their operations.

Admin Panel

Commission management systems handle complex fee structures, promotional discounts, and revenue sharing with restaurant partners. Flexible commission models accommodate different partnership types and business arrangements.

Promotional engines enable targeted marketing campaigns, seasonal offers, and loyalty program management. Advanced segmentation allows personalized offers based on user behavior, location, and ordering history.

Delivery zone control features manage service areas, delivery fees, and minimum order requirements. Geographic flexibility allows expansion into new areas while maintaining service quality standards.

How Does It Work? User Journey from Order to Delivery

The user experience begins with browsing restaurants filtered by cuisine type, delivery time, ratings, and price range. Advanced search functionality and personalized recommendations based on previous orders streamline the selection process.

Order placement involves menu selection, customization options, and special instructions. The checkout process includes delivery address confirmation, payment method selection, and estimated delivery time display.

Payment and confirmation happen seamlessly through secure payment gateways, with immediate order confirmation and estimated delivery time. Users receive SMS and app notifications confirming their order details.

Live tracking provides real-time updates on order preparation, driver assignment, and delivery progress. Interactive maps show driver location and estimated arrival time, while push notifications keep users informed of any changes.

Delivery completion includes final notifications, delivery confirmation, and rating prompts. Post-delivery features encourage user feedback and promote repeat orders through personalized offers.

How Does It Work? User Journey from Order to Delivery

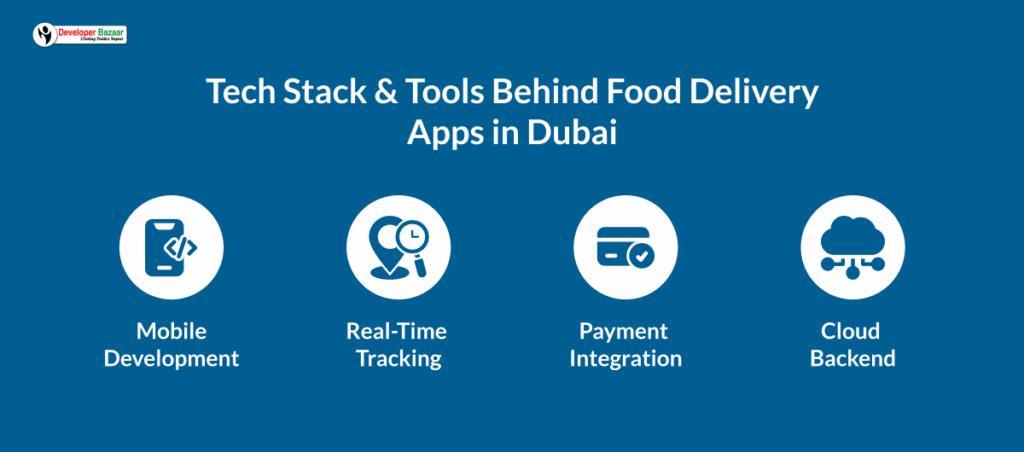

Building a reliable food delivery platform requires the right blend of mobile frameworks, cloud infrastructure, and integrations. Here’s a look at the key technologies powering Dubai’s top apps, from cross-platform development to real-time tracking and secure payments.

1. Mobile Development

Flutter has emerged as the preferred framework for food delivery app development in Dubai, offering cross-platform compatibility with native performance. React Native remains popular for teams with strong JavaScript expertise, while native development using Swift and Kotlin provides maximum performance for complex features.

2. Real-Time Tracking

Google Maps API integration provides accurate location services, route optimization, and real-time traffic updates. Mapbox offers enhanced customization options for branded mapping experiences, while local mapping services ensure compliance with UAE regulations.

3. Payment Integration

Stripe and PayFort dominate payment processing, supporting both international and local payment methods. Emirates NBD and ADCB provide specialized payment solutions for UAE businesses, while network tokenization ensures secure card data handling.

4. Cloud Backend

AWS and Microsoft Azure provide scalable cloud infrastructure with local data centers in the UAE. Google Cloud Platform offers strong AI and machine learning capabilities for demand forecasting and route optimization.

Role of a Food Delivery App Development Company

Partnering with the right development company is key to launching a successful food delivery app in the UAE. From local market insights and cultural nuances to technical expertise and regulatory compliance, here’s why choosing an experienced Dubai-based team makes all the difference.

1. Local Expertise Matters

Choosing a mobile application development company in Dubai provides crucial advantages in understanding local market dynamics, cultural preferences, and regulatory requirements. Local developers bring insights into consumer behavior patterns, seasonal trends, and cultural events that impact ordering habits.

Dubai-based development teams understand the importance of features like Ramadan timing adjustments, prayer time integration, and culturally appropriate marketing approaches. They also have established relationships with local payment processors, delivery services, and restaurant partners.

2. Technical and Business Guidance

A skilled food delivery app development company provides end-to-end solutions from market research and feature planning to deployment and ongoing support. They offer expertise in scaling applications to handle peak demand during events like the Dubai Food Festival or Ramadan.

The right development partner helps navigate local regulations, data privacy requirements, and business licensing procedures. They also provide ongoing technical support, feature updates, and performance optimization to ensure long-term success.

Monetization Models

Food delivery apps in the UAE rely on a mix of revenue streams to stay profitable and scalable. From flexible delivery fees to commission structures and in-app advertising, here’s how top platforms generate income while delivering value to both users and partners.

1. Delivery Fees

Variable delivery fees based on distance, time of day, and demand levels provide flexible revenue streams. Premium delivery options with faster service times command higher fees, while promotional free delivery campaigns drive customer acquisition.

2. Restaurant Commissions

Commission rates typically range from 15-30% of order value, varying based on restaurant exclusivity, marketing support, and order volume. Tiered commission structures reward high-performing partners while supporting smaller establishments with lower rates.

3. Subscription Plans

Monthly and annual subscription models offering free delivery, exclusive discounts, and priority support create recurring revenue streams. Premium memberships with additional benefits like extended customer support and exclusive restaurant access drive higher customer lifetime value.

4. In-App Advertising

Sponsored restaurant listings, featured placements, and promotional banners provide additional revenue opportunities. Targeted advertising based on user preferences and ordering history offers valuable marketing solutions for restaurant partners.

Conclusion

The UAE food delivery market represents a dynamic and rapidly evolving opportunity for entrepreneurs, established restaurant chains, and technology investors. Dubai’s position as a global business hub, combined with its tech-savvy population and supportive regulatory environment, creates ideal conditions for food delivery innovation.

Success in this market requires profound understanding of local preferences, robust technology infrastructure, and strategic partnerships with restaurants and delivery networks. The opportunity exists for both established players seeking expansion and new entrants with innovative approaches to serving Dubai’s diverse culinary landscape.

For entrepreneurs and F&B brands considering entry into this lucrative market, partnering with experienced developers who understand the local ecosystem is essential for building sustainable, profitable food delivery platforms.

FAQs

Q. What is the most popular food delivery app in Dubai?

Talabat leads with ~45% market share, thanks to broad restaurant partnerships and loyalty programs. Competitors include Deliveroo and Careem NOW.

Q. How much does it cost to develop a food delivery app in the UAE?

Costs range from $50,000–$150,000 for a full-featured app. MVPs start around $30,000–$60,000, while advanced AI-enabled platforms can exceed $200,000.

Q. How do food delivery startups in the UAE make money?

Revenue comes from delivery fees, restaurant commissions, subscriptions, and in-app ads. Many also partner with grocery and retail businesses.

Q. Which tech stack is used for food delivery apps?

Common stacks include Flutter or React Native (mobile), Node.js or Python (backend), MongoDB or PostgreSQL (database), AWS or Azure (cloud), Stripe or PayFort (payments), and Google Maps API (tracking).

Q. How long does it take to launch a food delivery app in Dubai?

Typically 6–12 months from planning to launch. MVPs can go live in 4–6 months, with more features added over time.

RM Mishra

Co-Founder

Developer Bazaar technologies